Why Britain Needs an IMF Programme

It's 50 years since the last one and it was a turning point; the UK needs another

Cambridge Professor and former Director of the National Institute of Economic and Social Research (NIESR), Jagjit Chadha, got me thinking about this when, to be honest, I had dismissed it as a silly season filler while Parliament and the courts are on recess.

I thought, "IMF loan, ridiculous" because I didn't see a sterling crisis as there was in 1976.

However, we are not far from a funding crisis, and a series of gilt auction failures is eminently possible, which could spread into a financial stability crisis. The Truss-Kwarteng "mini-budget" crisis in 2022 signals that the UK is sailing close to the budgetary wind.

Moreover, on further reflection and having been at the Fund, one of the significant benefits of an IMF program is the ability to implement measures a government knows are necessary but is unable to take due to domestic political constraints. "We're doing it because we have to, not because we want to."

Given Labour backbenchers' stance on spending, I've changed my view and think an IMF programme is exactly what Britain needs.

Think of it as a backbone transplant for PM Starmer.

Here’s what happened in 1976

Context

By mid-1976, Britain faced a sterling crisis and a loss of international market confidence.

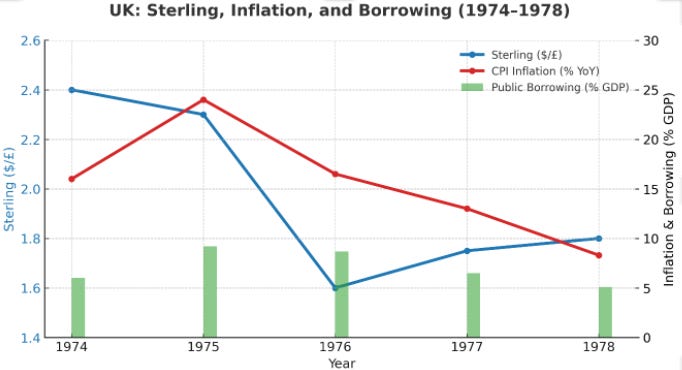

Inflation: peaked at 25% (1975), falling but still >15% in 1976.

Fiscal deficit: ~9% of GDP.

Sterling: plunged from $2.30 (early 1976) to below $1.60 (Oct 1976).

Reserves: rapidly depleted; gilt market under stress.

In December 1976, the Labour government (James Callaghan, Denis Healey) negotiated a record $3.9bn IMF standby loan.

What the Programme Required

Fiscal tightening: ~£2.5bn spending cuts (~2% of GDP).

Monetary control: ceilings on Domestic Credit Expansion (DCE).

Market credibility: IMF backing designed to stabilise sterling and reassure lenders.

Floating exchange rate: no formal devaluation; pound defended but allowed to adjust.

Outcomes

Sterling stabilised: climbed back above $1.80 by early 1977.

Inflation halved within two years.

Only half the IMF funds were actually drawn.

Policy orthodoxy shifted: fiscal discipline + monetary control replaced Keynesian demand management.

Legacy

Seen as the end of the post-war Keynesian consensus.

Strengthened the Treasury’s dominance over public spending.

Paved the way for Thatcher’s monetarist reforms.

Symbolised a turning point: market confidence became central to policy.

“We used to think you could spend your way out of recession… I tell you in all candour that option no longer exists.”

— James Callaghan, Labour Party Conference, September 1976

We went to the IMF in 1976 to borrow to repay a USD loan from the major central banks. On what basis would we need a non-GBP loan from the IMF today?